Japan must work toward strengthening the yen while avoiding the use of its vast U.S. Treasury holdings as a bargaining tool in trade disputes, according to Itsunori Onodera, the chair of the Liberal Democratic Party’s Policy Research Council. The comments come ahead of critical trade discussions with the United States, where currency policy is likely to be a contentious topic.

Speaking on NHK, a Japanese public broadcaster, Onodera emphasized that Japan, as a close ally of the United States, should not resort to selling its U.S. Treasury holdings in retaliation against Washington’s recent tariff measures. This follows growing speculation about whether Japan might leverage its position as the largest foreign holder of U.S. government debt in ongoing negotiations.

“As a U.S. ally, the government shouldn’t think about intentionally using U.S. Treasury holdings,” Onodera stated, rejecting a suggestion from opposition lawmakers to use Japan’s $1.079 trillion in Treasuries as a tool to counter President Donald Trump’s trade policies.

Weak Yen Driving Inflation

Onodera’s remarks also highlighted concerns about the yen’s prolonged weakness, which has exacerbated inflation and increased household costs across Japan. While the Japanese currency has recently regained some ground, its broader downtrend over the past few years has been a challenge for policymakers.

“The weak yen has been among factors pushing up prices,” Onodera said. “To strengthen the yen, it’s important to strengthen Japanese companies.” His remarks seemed to signal that the priority for Japan’s government is addressing the root causes of the yen’s decline, such as improving industrial competitiveness, rather than relying on short-term interventions.

Trade Talks and Currency Policy

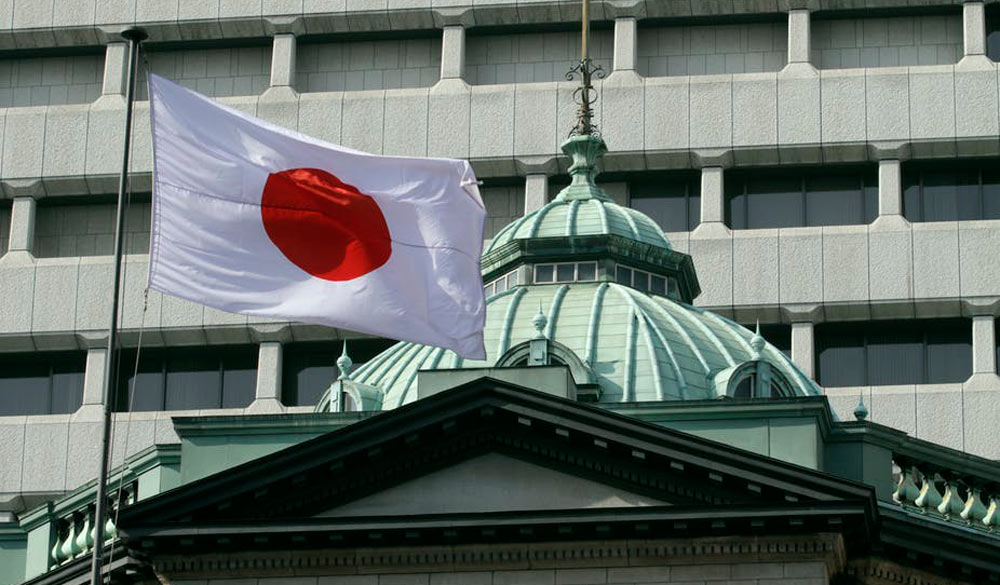

This week’s bilateral trade talks between Japan and the United States are expected to focus heavily on currency issues. Washington has reportedly been pressuring Tokyo to support a stronger yen and increase its pace of monetary tightening. The Bank of Japan’s (BOJ) ultra-low interest rate policy has been a key factor in the yen’s weakness, especially as the Federal Reserve has aggressively raised rates in recent years.

Ryosei Akazawa, Japan’s minister for economic revitalization, is set to meet with U.S. Treasury Secretary Scott Bessent on Thursday to discuss trade and currency policies. Sources familiar with the negotiations suggest that Japan’s gradual approach to raising interest rates may come under scrutiny during these discussions.

A History of Yen Intervention

Japan has historically been cautious about allowing the yen to strengthen too much, as a stronger currency can hurt its export-reliant economy. However, the dramatic depreciation of the yen in recent years has shifted the focus. In 2022 and 2023, Tokyo intervened in foreign exchange markets to prop up the yen as it slid to nearly 160 yen per dollar, a level not seen in decades.

The yen has recently rallied, reaching 142.895 per dollar on Friday, its strongest level since September. This rebound comes amid a broader sell-off in the U.S. dollar, which has been under pressure from market volatility following tariff-related tensions.

Treasury Holdings and Trade Tensions

Japan’s massive holdings of U.S. Treasuries have been a focal point in global markets, particularly during periods of heightened trade tensions. While some countries, such as China, have reportedly reduced their U.S. debt holdings in response to diplomatic disputes, Japan appears to be taking a more measured approach.

Onodera’s comments reinforce the notion that Japan views its Treasury holdings as a stabilizing force in the global financial system rather than a tool for retaliation. This perspective stands in contrast to market speculation that Japan might sell Treasuries as a countermeasure to U.S. tariffs, a move that could have significant repercussions for global markets.