What are you searching for ?

College Information

Financial Aid

Cost Summary

Total College Cost

Net Cost (After Aid)

Amount to Borrow

Monthly Loan Payment (10 years)

Annual Cost Breakdown

Understanding College Costs: A Comprehensive Guide

Planning for college expenses is one of the most significant financial decisions families face. With rising education costs, understanding and calculating the true cost of college has become more important than ever. This comprehensive guide will help you navigate the complex landscape of college financing and make informed decisions about your educational investment.

What Makes Up College Costs?

College expenses extend far beyond tuition fees. The total cost of attendance includes several key components that families must consider when budgeting for higher education:

Tuition and Fees represent the direct educational costs charged by the institution. These vary significantly between public and private schools, with private colleges typically charging $35,000-$50,000 annually, while in-state public universities average $10,000-$15,000 per year.

Room and Board costs cover housing and meal plans, averaging $12,000-$15,000 annually. Students living off-campus may face different expenses, but the total housing and food costs often remain similar.

Books and Supplies typically cost $1,200-$1,500 per year, though this can vary by major. Science and engineering programs often require more expensive materials and equipment.

Hidden Costs Often Overlooked

Many families underestimate additional expenses that can significantly impact the total college budget. Personal expenses, including clothing, entertainment, and miscellaneous items, typically range from $1,500-$3,000 annually.

Transportation costs vary greatly depending on the distance from home and frequency of travel. Students attending college far from home may spend $1,000-$2,500 annually on travel expenses.

Technology costs, including laptops, software, and other electronic devices required for coursework, can add $1,000-$2,000 to the total college expenses, particularly in the first year.

The Impact of Inflation on College Costs

College costs historically increase at rates higher than general inflation. Over the past decade, college expenses have grown at approximately 3-5% annually. This means that families planning for future college attendance must account for these increases in their calculations.

For families with young children, a college education that costs $50,000 today may cost $75,000-$90,000 in 15 years. This inflation factor makes early planning and consistent saving crucial for college affordability.

Financial Aid and Its Role

Understanding the financial aid landscape is essential for accurate college cost planning. Financial aid comes in several forms, each with different implications for families:

Grants and Scholarships provide free money that doesn't need to be repaid. These can be need-based or merit-based, and significantly reduce the net cost of college attendance.

Work-Study Programs offer part-time employment opportunities for students, typically providing $2,000-$4,000 annually while allowing students to gain work experience.

Student Loans bridge the gap between college costs and available funds, but they must be repaid with interest after graduation. Understanding loan terms and future payment obligations is crucial for informed borrowing decisions.

Strategies for Managing College Costs

Families can employ various strategies to reduce college expenses and manage costs effectively. Starting at community college for general education requirements can save thousands of dollars while providing a strong academic foundation.

Applying for multiple scholarships and grants can significantly reduce the need for student loans. Many scholarships go unclaimed each year, making persistent application efforts worthwhile.

Choosing in-state public universities over private institutions can result in substantial savings, often without compromising educational quality. Many public universities offer honors programs and research opportunities comparable to private schools.

Planning Timeline and Savings Strategies

Effective college planning should begin as early as possible. Starting a college savings account when a child is young allows families to take advantage of compound growth over time.

529 education savings plans offer tax advantages for college savings, allowing contributions to grow tax-free when used for qualified educational expenses. These plans have become increasingly popular tools for college planning.

Regular contributions to college savings accounts, even modest amounts, can accumulate significantly over time. Families contributing $200-$300 monthly from a child's birth may accumulate $60,000-$80,000 by college age.

Making Informed Decisions

Using a college cost calculator helps families understand the true financial commitment of higher education. These tools consider inflation, financial aid, and loan implications to provide realistic cost projections.

Comparing costs across different institutions and considering factors like graduation rates, job placement statistics, and alumni earnings can help families evaluate the return on their educational investment.

Understanding loan repayment obligations is crucial for students and families. A general rule suggests that total student loan debt should not exceed the expected first-year salary after graduation.

College cost planning requires careful consideration of multiple factors and long-term financial implications. By understanding all components of college expenses, utilizing available financial aid, and implementing strategic savings plans, families can make higher education more affordable and accessible. The key is starting early, staying informed, and making decisions based on comprehensive financial analysis rather than assumptions.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

Business

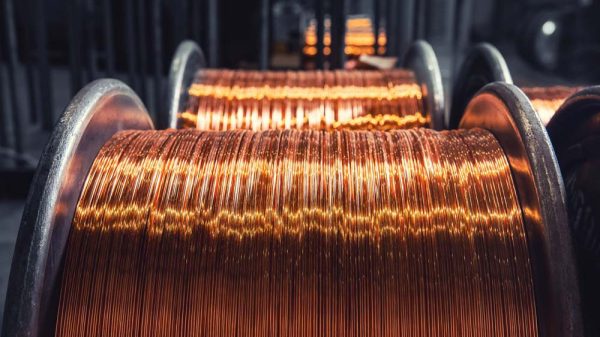

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...