What are you searching for ?

Credit Card Calculator

Calculate payments, payoff time, and total interest on your credit cards

Credit Card Details

Results

Understanding Credit Card Calculations: A Complete Guide

Credit cards can be powerful financial tools when used wisely, but understanding how interest calculations work is crucial for managing your debt effectively. This comprehensive guide will help you understand the mechanics behind credit card calculations and how to use them to your advantage.

How Credit Card Interest is Calculated

Credit card interest is typically calculated using the Average Daily Balance method. Here's how it works:

Monthly Interest = Daily Interest Rate × Average Daily Balance × Days in Billing Cycle

For example, if you have a $5,000 balance with an 18% APR, your daily interest rate would be 0.0493% (18% ÷ 365). Over a 30-day billing cycle, you'd pay approximately $74.03 in interest charges.

Minimum Payment Calculations

Credit card companies typically calculate minimum payments using one of these methods:

- Percentage Method: Usually 1-3% of your outstanding balance

- Interest Plus Principal: All accrued interest plus a small percentage of the principal

- Fixed Minimum: A set dollar amount, typically $25-35, whichever is higher

The True Cost of Minimum Payments

Making only minimum payments can be extremely expensive over time. Consider this example:

Real-World Example:

A $5,000 balance at 18% APR with a 2% minimum payment would take over 30 years to pay off and cost more than $11,000 in total interest!

Payment Strategies to Save Money

Here are proven strategies to reduce your credit card debt faster and save on interest:

1. Pay More Than the Minimum

Even an extra $25-50 per month can significantly reduce your payoff time and total interest paid. The key is consistency.

2. Target High-Interest Cards First

If you have multiple cards, focus on paying off the highest interest rate cards first while maintaining minimum payments on others. This strategy, known as the "avalanche method," minimizes total interest costs.

3. Consider Balance Transfers

Moving high-interest debt to a card with a lower rate or promotional 0% APR can provide breathing room, but be aware of transfer fees and the promotional period's end date.

4. Set a Target Payoff Date

Having a specific goal helps you calculate exactly how much you need to pay monthly to become debt-free by your target date.

Understanding Different APR Types

Credit cards may have different APRs for different types of transactions:

- Purchase APR: Rate for regular purchases

- Cash Advance APR: Usually higher rate for cash advances

- Balance Transfer APR: Rate for transferred balances

- Penalty APR: Higher rate triggered by late payments

Tips for Using Credit Card Calculators Effectively

To get the most accurate results from credit card calculators:

- Use your most recent statement balance and APR

- Include any annual fees in your calculations

- Consider your entire financial picture, not just individual cards

- Factor in your realistic ability to make payments consistently

- Update calculations regularly as balances change

Beyond the Calculator: Building Better Credit Habits

While calculators help you understand the numbers, building good credit habits is essential for long-term financial health:

Best Practices:

- Pay your full balance each month to avoid interest entirely

- Keep credit utilization below 30% of your limit

- Set up automatic payments to avoid late fees

- Review statements monthly for accuracy

- Avoid using credit cards for cash advances

When to Seek Professional Help

If you're struggling with credit card debt, consider these options:

- Credit counseling services for budgeting help

- Debt management plans for structured repayment

- Speaking with your card issuer about hardship programs

- Consulting with a financial advisor for comprehensive planning

Remember, the goal isn't just to pay off current debt but to develop sustainable financial habits that prevent future debt accumulation. Use credit card calculators as tools to inform your decisions, but combine them with disciplined spending and consistent payment habits for the best results.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

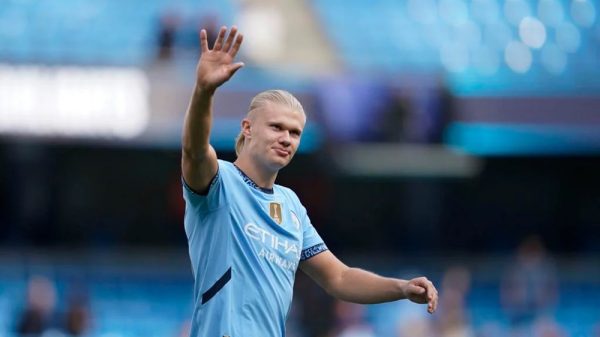

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

Business

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...