What are you searching for ?

Enter Your Work Details

Your Earnings Breakdown

Total Earnings

Annual Projection

Understanding Overtime Pay Calculation

Overtime pay is a crucial component of fair compensation for employees who work beyond their regular hours. Understanding how overtime is calculated can help both employers and employees ensure accurate payroll processing and fair compensation.

What is Overtime Pay?

Overtime pay is additional compensation paid to employees who work more than their standard working hours. In most jurisdictions, this typically applies to hours worked beyond 40 hours per week for hourly employees, though specific rules vary by location and employment agreements.

How Overtime is Calculated

The most common overtime calculation method involves these key components:

- Regular Hours: Standard working hours (typically 40 hours per week)

- Overtime Hours: Any hours worked beyond the regular schedule

- Overtime Rate: The multiplier applied to the regular hourly rate (commonly 1.5x or "time and a half")

- Base Hourly Rate: The employee's standard hourly wage

Common Overtime Rates

Different overtime rates apply depending on circumstances and local regulations:

- Time and a Half (1.5x): The most common rate for overtime hours

- Double Time (2x): Often applied for holidays, excessive overtime, or special circumstances

- Custom Rates: Some employers offer 1.25x or 1.75x rates based on company policy

Calculation Formula

The basic formula for overtime calculation is:

Total Pay = (Regular Hours × Hourly Rate) + (Overtime Hours × Hourly Rate × Overtime Multiplier)

For example, if an employee works 45 hours at $20/hour with 1.5x overtime:

- Regular Pay: 40 hours × $20 = $800

- Overtime Pay: 5 hours × $20 × 1.5 = $150

- Total Pay: $800 + $150 = $950

Important Considerations

When calculating overtime, consider these factors:

- Legal Requirements: Overtime laws vary by jurisdiction and may have specific rules for different industries

- Exempt vs. Non-Exempt: Not all employees are eligible for overtime pay

- Pay Periods: Overtime calculations may differ for weekly, bi-weekly, or monthly pay periods

- Holiday Pay: Special rates may apply for work performed on holidays

Benefits of Accurate Overtime Calculation

Proper overtime calculation ensures:

- Legal compliance with labor laws

- Fair compensation for employees

- Accurate budgeting and payroll planning

- Improved employee satisfaction and retention

- Protection against potential legal issues

Using This Calculator

Our overtime calculator simplifies the process by automatically computing your total earnings based on regular hours, overtime hours, and applicable rates. Simply input your hourly rate or annual salary, specify your working hours, and select the appropriate overtime multiplier to get accurate results instantly.

Whether you're an employee wanting to verify your paycheck or an employer ensuring accurate payroll processing, this calculator provides the precision and convenience you need for reliable overtime calculations.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

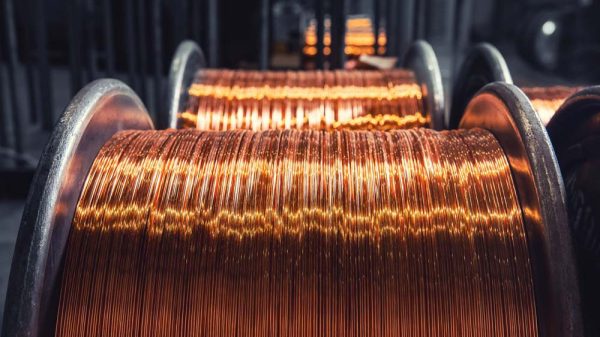

Business

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...