What are you searching for ?

Property & Financial Details

Results

Enter your details and click "Calculate"

Get a comprehensive comparison of renting vs. buying costs

Understanding the Rent vs. Buy Decision

Deciding whether to rent or buy a home is one of the most significant financial decisions you'll make. Our Rent vs. Buy Calculator helps you analyze the true costs and benefits of each option based on your specific situation and local market conditions.

How the Calculator Works

The calculator compares the total cost of homeownership against renting over your specified time period. It considers numerous factors that many people overlook when making this important decision:

- Purchase Price and Down Payment: The initial home cost and your upfront investment

- Mortgage Details: Interest rate and loan term affecting your monthly payments

- Ongoing Ownership Costs: Property taxes, insurance, maintenance, and HOA fees

- Rental Costs: Current rent and expected annual increases

- Market Factors: Home appreciation rates and inflation effects

- Time Horizon: How long you plan to stay in the property

Key Factors in the Rent vs. Buy Decision

Financial Considerations: Beyond the monthly payment comparison, homeownership involves significant upfront costs including down payment, closing costs, and moving expenses. The calculator factors in opportunity costs of your down payment and ongoing maintenance expenses that renters don't face.

Time Horizon: The length of time you plan to stay in a property significantly impacts the rent vs. buy decision. Buying typically becomes more advantageous the longer you stay, as you build equity and spread transaction costs over more years.

Market Conditions: Local real estate markets vary dramatically. In high-appreciation areas, buying may be favorable even with higher monthly costs. In stable or declining markets, renting might provide better financial flexibility.

Benefits of Buying

- Build equity and potential wealth through property appreciation

- Stability and control over your living environment

- Potential tax benefits from mortgage interest deductions

- Protection against rent increases

- Freedom to modify and improve your property

Benefits of Renting

- Lower upfront costs and greater financial flexibility

- No responsibility for maintenance, repairs, or property taxes

- Easier to relocate for career or lifestyle changes

- Predictable monthly housing costs

- Access to amenities you might not afford as an owner

Making Your Decision

While our calculator provides valuable financial insights, remember that the rent vs. buy decision isn't purely mathematical. Consider your lifestyle preferences, career stability, family plans, and local market conditions. The "right" choice varies significantly based on individual circumstances and personal priorities.

Use this calculator as a starting point for your analysis, but also consult with real estate professionals, financial advisors, and mortgage lenders to get a complete picture of your options in your specific market.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

Business

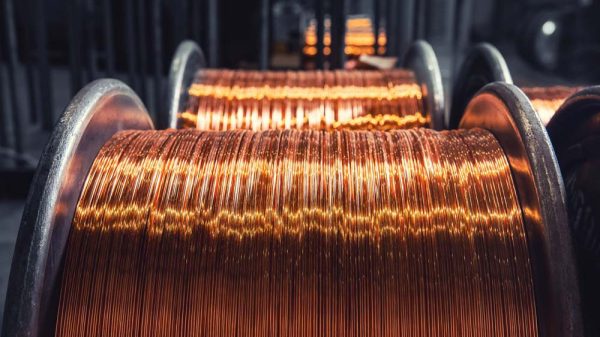

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...