What are you searching for ?

Professional Savings Calculator

Calculate your take-home pay, taxes, and benefits with precision

Enter Your Salary Details

Your Salary Breakdown

Understanding Your Salary: A Complete Guide to Salary Calculations

Calculating your salary accurately is crucial for financial planning, budgeting, and making informed career decisions. Whether you're negotiating a new job offer, planning your monthly expenses, or evaluating a career change, understanding how your gross salary translates to take-home pay is essential.

What is Gross vs. Net Salary?

Your gross salary is your total earnings before any deductions, while your net salary (take-home pay) is what remains after taxes, benefits, and other deductions are subtracted. The difference between these two figures can be substantial, often ranging from 20% to 40% depending on your tax bracket and benefit elections.

Key Insight: A $75,000 gross salary typically results in approximately $55,000-$60,000 in take-home pay, depending on your location, tax situation, and benefit deductions.

Common Salary Deductions

Understanding what gets deducted from your paycheck helps you plan better and avoid surprises. Here are the most common deductions:

- Federal Income Tax: Varies based on tax brackets, typically 10-37% of taxable income

- State Income Tax: Ranges from 0-13% depending on your state

- Social Security Tax: 6.2% on income up to the annual wage base limit

- Medicare Tax: 1.45% on all income, plus 0.9% additional tax on high earners

- Health Insurance Premiums: Varies widely, typically $200-$800 monthly

- Retirement Contributions: 401(k), 403(b), or similar pre-tax contributions

- Other Benefits: Dental, vision, life insurance, FSA/HSA contributions

Pay Frequency Impact on Budgeting

Your pay frequency significantly affects your cash flow and budgeting strategy. Here's how different pay schedules work:

- Weekly (52 paychecks): Consistent weekly income, easier for weekly budgeters

- Bi-weekly (26 paychecks): Most common, results in two "extra" paychecks per year

- Semi-monthly (24 paychecks): Fixed dates (e.g., 15th and 30th), consistent monthly budgeting

- Monthly (12 paychecks): Requires careful monthly budgeting, common for salaried professionals

Budgeting Tip: If you're paid bi-weekly, budget based on 24 paychecks per year and treat the two "extra" paychecks as bonuses for savings or debt reduction.

Maximizing Your Take-Home Pay

While you can't control tax rates, you can optimize your salary structure to maximize your net pay:

- Pre-tax Contributions: Maximize 401(k), HSA, and FSA contributions to reduce taxable income

- Tax Withholding: Adjust your W-4 to avoid overpaying taxes throughout the year

- Benefit Selection: Choose cost-effective health insurance and benefit options

- Location Considerations: Factor in state tax differences when considering job relocations

Planning for Financial Success

Once you understand your take-home pay, you can create a sustainable financial plan. Financial experts recommend the 50/30/20 rule:

- 50% for Needs: Housing, utilities, groceries, minimum debt payments

- 30% for Wants: Entertainment, dining out, hobbies, non-essential purchases

- 20% for Savings: Emergency fund, retirement beyond employer match, debt payoff

Pro Tip: Use this calculator regularly when evaluating job offers, planning major purchases, or considering changes to your benefit elections. Small adjustments can lead to significant long-term financial improvements.

Beyond Basic Salary Calculations

Modern compensation packages extend beyond base salary. When evaluating your total compensation, also consider:

- Health insurance value and coverage quality

- Employer 401(k) matching contributions

- Paid time off and sick leave policies

- Professional development opportunities and education reimbursement

- Stock options, bonuses, and performance incentives

- Flexible work arrangements and work-life balance benefits

By understanding all components of your compensation and using tools like this salary calculator, you can make informed decisions about your career and financial future. Remember that salary is just one part of your overall financial picture, but it's the foundation upon which your budget and financial goals are built.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

Business

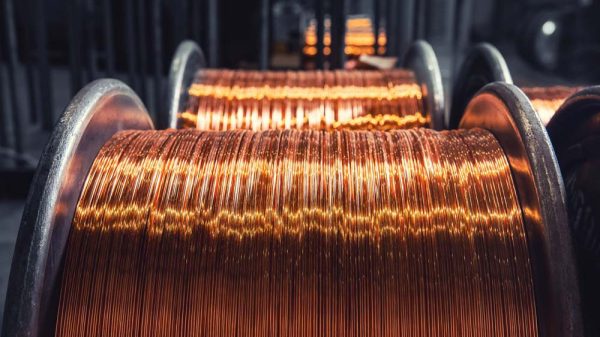

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...