What are you searching for ?

Understanding VAT Calculator: A Comprehensive Guide

Value Added Tax (VAT) is a consumption tax that plays a crucial role in modern economies worldwide. Whether you're a business owner, accountant, or consumer, understanding how to calculate VAT accurately is essential for financial planning and compliance.

What is VAT and Why Does It Matter?

VAT is a tax on the value added to goods and services at each stage of production and distribution. Unlike sales tax, which is only applied at the point of sale, VAT is collected incrementally throughout the supply chain. This system ensures that tax is paid on the actual value addition at each step, making it more efficient and harder to evade.

For businesses, VAT represents both a cost and a revenue stream. Companies must charge VAT on their sales (output tax) while paying VAT on their purchases (input tax). The difference between these amounts determines whether a business owes money to or receives a refund from the tax authorities.

How VAT Calculation Works

VAT calculations involve two primary scenarios: adding VAT to a net amount and removing VAT from a gross amount. Understanding both processes is crucial for accurate financial management.

Adding VAT: When you need to calculate the total price including VAT, you multiply the net amount by (1 + VAT rate). For example, with a 20% VAT rate, you multiply by 1.20. This gives you the gross amount that customers will pay.

Removing VAT: When you have a gross amount and need to determine the net amount and VAT component, you divide the gross amount by (1 + VAT rate). The difference between the gross and net amounts represents the VAT portion.

VAT Rates Around the World

VAT rates vary significantly across different countries and regions. European Union countries typically have standard rates ranging from 17% to 27%, with most hovering around 20-25%. Many countries also implement reduced rates for essential goods like food, books, and medical supplies, which can be as low as 0-10%.

Understanding these variations is particularly important for international businesses that must comply with VAT regulations in multiple jurisdictions. Each country has its own rules about what goods and services are subject to standard rates, reduced rates, or exemptions.

Common VAT Calculation Scenarios

Businesses encounter various VAT calculation scenarios in their daily operations. Retailers need to add VAT to their selling prices to determine what customers pay. Wholesalers often work with VAT-inclusive prices and need to extract the VAT component for their accounting records.

Service providers face unique challenges when calculating VAT, especially when dealing with international clients or digital services. The location of the customer, the nature of the service, and applicable tax treaties all influence the VAT treatment.

Benefits of Using a VAT Calculator

A reliable VAT calculator eliminates the risk of manual calculation errors and ensures consistency across all transactions. It saves time, particularly when dealing with multiple VAT rates or complex scenarios involving discounts and bulk pricing.

Professional VAT calculators also help maintain accurate records for tax reporting and audit purposes. They provide clear breakdowns of net amounts, VAT portions, and total amounts, making it easier to reconcile accounts and prepare VAT returns.

Best Practices for VAT Management

Effective VAT management requires systematic approaches to calculation, recording, and reporting. Businesses should establish clear procedures for handling VAT in different scenarios and ensure all staff understand these processes.

Regular reconciliation of VAT accounts helps identify discrepancies early and ensures compliance with tax regulations. Keeping detailed records of all VAT calculations and the rationale behind rate applications is essential for audit preparation and dispute resolution.

By understanding VAT principles and utilizing reliable calculation tools, businesses can maintain accurate financial records, ensure regulatory compliance, and make informed pricing decisions. Whether you're adding VAT to determine customer prices or removing VAT for accounting purposes, precision in these calculations is fundamental to successful business operations.

Latest News

ai

The concept of implanting brain chips to enhance human intelligence is no longer confined to the realm of science fiction. Visionaries like Elon Musk...

Economic

The Premier League, often regarded as the world’s most competitive football league, has once again proven its substantial economic contribution to the UK’s treasury....

Business

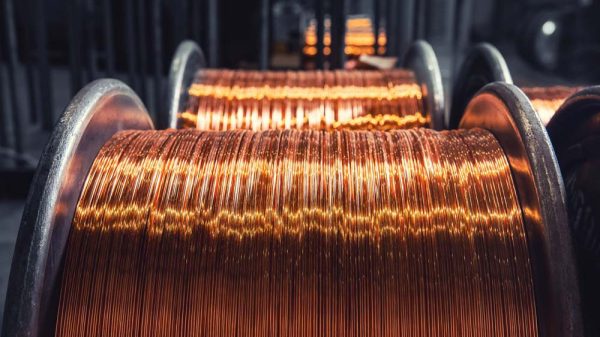

Copper prices have continued their downward spiral after reaching record highs, leaving market participants wondering if optimistic Chinese investors will resume buying amid a...

Business

The cryptocurrency market experienced a significant downturn as Bitcoin fell sharply below the $80,000 mark for the first time since April 2025. This decline,...