President Donald Trump’s escalating trade war is sending shockwaves through global markets, with the latest round of sector-specific tariffs targeting critical commodities and products. The tariffs, which include steep levies on cars, copper, and aluminum, are drawing criticism from U.S. trading partners, businesses, and consumers alike.

Trump’s aggressive use of Section 232 tariffs, which allow the president to bypass Congress in the name of national security, is reshaping the U.S. trade landscape. With tariffs on steel and aluminum imports now doubled to 50%, and a 50% tariff on copper imports recently announced, the economic ripple effects are becoming increasingly evident.

Copper Prices Soar After Tariff Announcement

Trump’s announcement of the 50% tariff on copper imports has already caused a significant market reaction. On Tuesday, copper futures for September surged 13%, closing at $5.6855 per pound — the largest single-day gain since 1989. Copper, a critical component in electrical wiring and infrastructure, is now more expensive, raising concerns about cost increases across multiple industries.

“Today, we’re doing copper,” Trump said, signaling that additional tariffs on other commodities could follow.

Additional Tariffs Create Uncertainty for U.S. Businesses

The president’s tariff strategy also includes a 200% levy on pharmaceutical imports, a move expected to disrupt the healthcare and pharmaceutical industries. Additionally, Trump has imposed a 25% tariff on cars and auto parts, which will disproportionately impact major exporters like Japan and South Korea.

These tariffs are layered on top of existing duties on steel and aluminum, further straining supply chains. While the White House signed an executive order in April to prevent auto tariffs from being stacked with steel and aluminum levies, experts warn that the long-term effects of these measures could take years to materialize.

Global Trade Partners Under Pressure

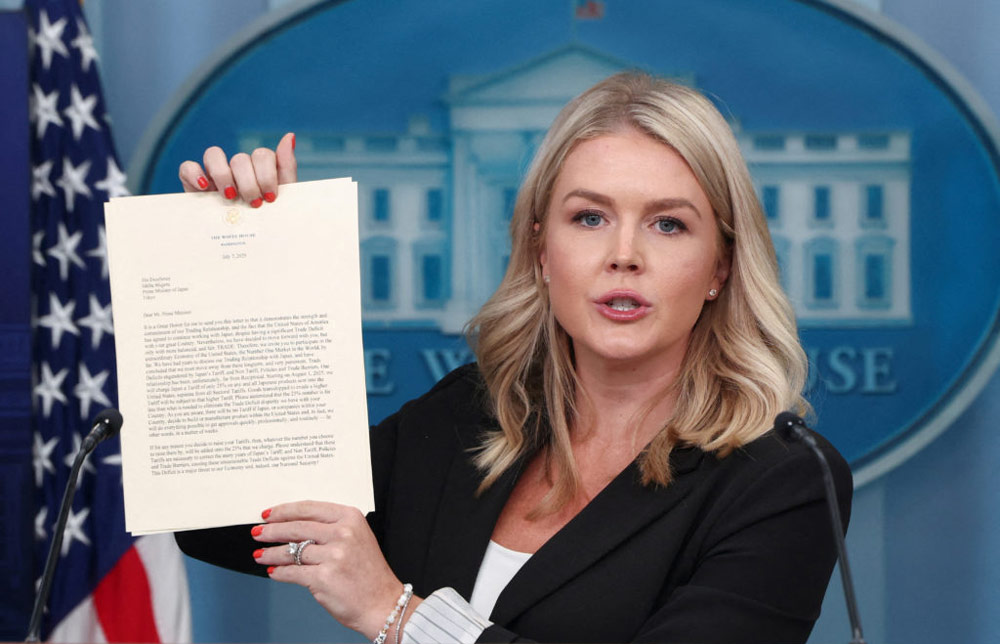

The latest round of tariffs comes as Trump prepares to impose sweeping duties on imports from 14 countries, including Japan, South Korea, and South Africa, starting August 1. These nations are key producers of steel, aluminum, and other commodities now subject to higher tariffs.

The administration’s strategy appears aimed at forcing U.S. trade partners to negotiate favorable deals before the August deadline. However, many countries remain in limbo, with some pushing for exemptions amid ongoing negotiations.

“Reciprocal tariffs are making headlines, but the product-specific tariffs will still have a significant impact on the domestic market,” said Mike Lowell, a trade expert at law firm ReedSmith.

Legal and Economic Implications

Trump’s reliance on Section 232 tariffs is central to his trade policy. Unlike his country-specific tariffs, which are facing legal challenges, these sector-based duties have a stronger legal foundation and are more likely to survive court scrutiny. Experts believe these tariffs could persist into future administrations, as seen with the steel and aluminum tariffs imposed during Trump’s first term.

However, critics argue that these measures could backfire, leading to higher prices for U.S. consumers and businesses. The White House has downplayed concerns about tariff-related inflation, likening the risk to “pandemics or meteors” — rare but significant events.

Ripple Effects on Key Industries

The tariffs are already impacting industries that rely heavily on imported materials. Steel and aluminum, essential for products like cars, refrigerators, and kitchenware, have seen price spikes since the tariffs were first introduced. Now, with higher rates layered on top of existing duties, businesses are bracing for further disruptions.

The auto industry, in particular, has raised alarms about the potential long-term consequences of the tariffs. Supply chains often take years to adjust, meaning the full impact of these measures may not be felt immediately.

What’s Next?

While the White House has teased the possibility of new trade deals, shifting deadlines and additional tariffs are creating uncertainty for businesses and trade partners alike. Trump has hinted at further sector-specific tariffs, including on agricultural products, technology like iPhones, and even lumber imports.

For now, the administration appears committed to using tariffs as a tool to reshape the U.S. economy and gain leverage over trading partners. Whether this strategy will succeed remains to be seen, but the immediate effects are clear: higher prices, strained supply chains, and growing unease among businesses and consumers.