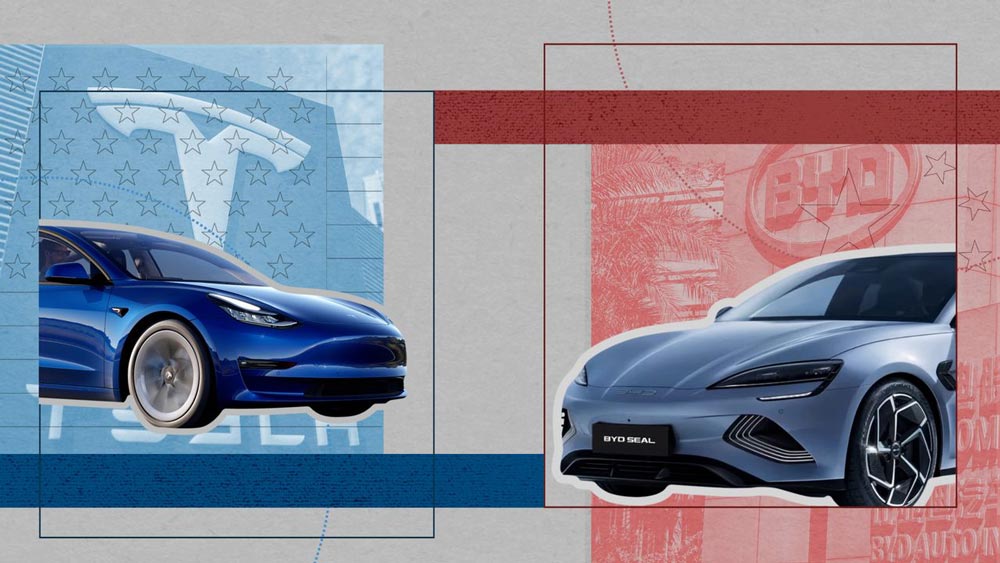

Chinese electric vehicle (EV) manufacturer BYD has officially overtaken Tesla in annual revenue, reporting a record 777 billion yuan (approximately $107 billion) for 2024. This marks a significant milestone in the EV industry, as competition between the two giants continues to intensify.

In comparison, Tesla reported $97.7 billion in revenue for the same period, falling short of BYD’s achievements. The gap underscores BYD’s rapid expansion and growing dominance in the global EV market.

BYD’s Growth and Market Leadership

BYD’s impressive 29% increase in annual revenue from the previous year can be attributed to strong sales of its hybrid and new energy vehicles. The company also achieved a historic milestone in November 2024 by becoming the first automaker globally to produce and sell 10 million new energy vehicles.

Wang Chuanfu, BYD’s chairman and president, praised the company’s success, stating:

“BYD has become an industry leader in every sector from batteries, electronics to new energy vehicles, breaking the dominance of foreign brands and reshaping the new landscape of the global market.”

The company’s success is further amplified by its innovation in battery technology and energy solutions. BYD recently unveiled a groundbreaking battery platform that has the potential to revolutionize EV charging.

Game-Changing Battery Technology

BYD announced its new “Super e-Platform” last week, which it claims can achieve 400 kilometers (roughly 249 miles) of range with just five minutes of charging. If these claims hold true, the platform could address one of the biggest challenges in EV adoption—long charging times.

Analysts have described the technology as “out of this world” and predict it could significantly alter consumer behavior, making EVs even more appealing to a broader audience.

Market Performance

BYD’s remarkable performance has also been reflected in its stock price. The company’s Hong Kong-listed shares have surged by 46% year-to-date, making it one of the top-performing stocks in the EV sector.

On the other hand, Tesla’s shares have experienced a sharp decline of over 31% this year. Analysts attribute this to rising consumer boycotts and decreasing demand, exacerbated by Elon Musk’s controversial political affiliations and public image.

A Shift in the EV Landscape

BYD’s rise signifies a notable shift in the global EV landscape. Historically dominated by Tesla and other Western automakers, the industry is now witnessing the emergence of Chinese companies as key players. BYD’s comprehensive approach—spanning batteries, electronics, and vehicle manufacturing—has positioned it as a formidable competitor.

With its focus on innovation and market expansion, BYD is poised to continue its upward trajectory. As the EV industry grows, the rivalry between Tesla and BYD is expected to shape the future of sustainable transportation.