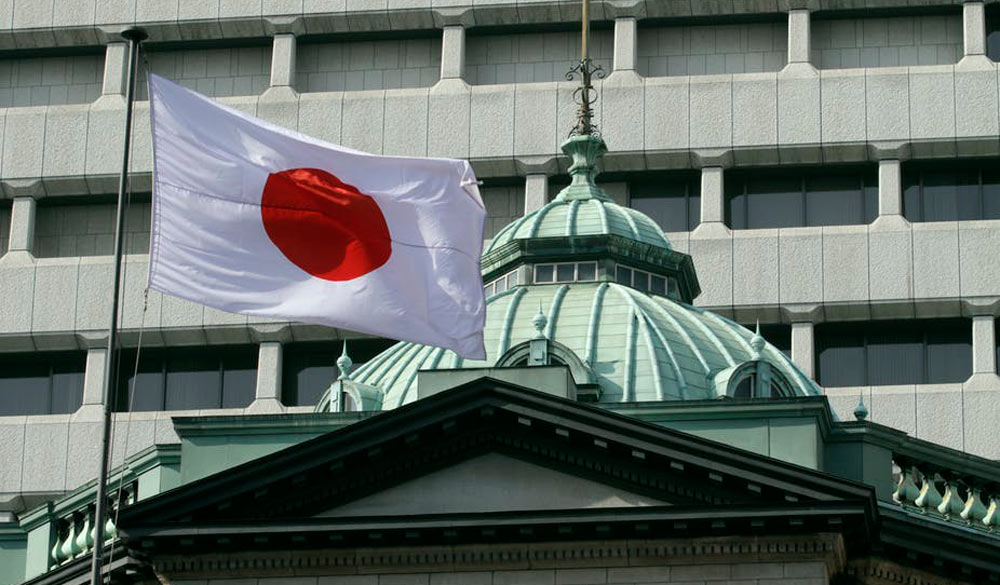

In a landmark move, the Bank of Japan (BOJ) announced the end of the world’s only negative rates regime, marking a historic shift in monetary policy. The decision, made at the conclusion of the two-day March policy meeting, signifies a significant departure from the unconventional measures that were implemented over the past several decades to combat deflation. This move by the BOJ comes before the highly anticipated interest rate decision by the U.S. Federal Reserve later this week.

Positive Interest Rates and Yield-Curve Control

The BOJ raised its short-term interest rates from -0.1% to 0% to 0.1%, effectively putting an end to the negative rates regime that had been in place since 2016. This decision aims to normalize the interest rate environment and reflects the central bank’s confidence in the Japanese economy’s ability to achieve stable inflation.

Furthermore, the BOJ abandoned its yield-curve control policy, which targeted longer-term interest rates through bond purchases. While it will no longer employ this specific policy tool, the central bank will continue to purchase government bonds worth a similar amount as before, about 6 trillion yen per month. In the face of rapid increases in long-term interest rates, the BOJ is prepared to respond with nimble measures, including increased purchases of Japanese government bonds (JGBs) and fixed-rate purchases of JGBs.

Reduction in Asset Purchases

To further scale back its expansive monetary policy, the BOJ has made the decision to stop buying exchange-traded funds (ETFs), Japan real estate investment trusts (J-REITS), commercial paper, and corporate bonds. The central bank plans to gradually reduce its purchases of these assets over the course of approximately one year. BOJ Governor Kazuo Ueda described these holdings as remnants of the extraordinary monetary easing scheme.

Caution and Future Outlook

While the BOJ’s decision to raise interest rates marks a significant shift, the central bank remains cautious about embarking on aggressive rate hikes. It anticipates maintaining accommodative financial conditions for the time being, given the fragile nature of the Japanese economy’s growth. BOJ Governor Ueda emphasized that there is still some distance to go for inflation expectations to reach the target of 2%.

Market Impact

The announcement by the BOJ had an immediate impact on the financial markets. The yen weakened against major currencies, bond yields slipped, and the Nikkei stock index experienced volatility but ultimately closed higher. Investors and market participants will be closely monitoring the effects of this policy shift on the Japanese economy and its implications for global markets.