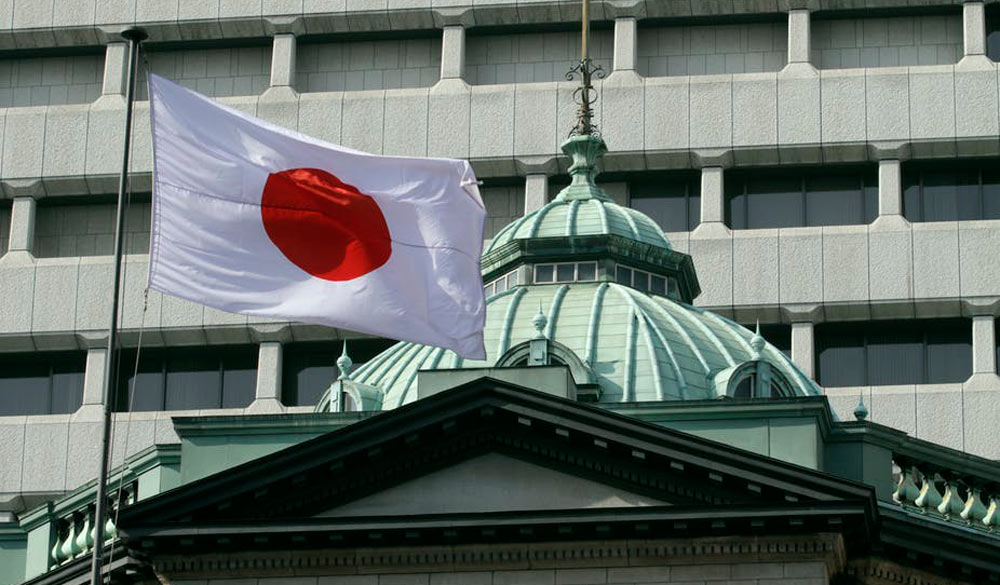

In a recent decision that reverberated through financial markets, the Bank of Japan (BOJ) announced its commitment to maintaining its ultra-easy monetary policy. The central bank’s choice to stick with its accommodative stance was driven by the prevalence of significant uncertainties in the economic landscape. As a result, the Japanese yen experienced a sharp decline in value. This article delves into the BOJ’s decision, the rationale behind it, and its potential implications for the Japanese economy and global markets.

The BOJ’s Monetary Policy and Yield Curve Control

During its final meeting of the year, the BOJ unanimously voted to keep interest rates at -0.1% and maintain its yield curve control policy. This policy framework sets a 1% upper limit for the yield on 10-year Japanese government bonds. By implementing these measures, the central bank aims to support lending, stimulate economic growth, and achieve its inflation target of 2%.

Uncertainties and the BOJ’s Dilemma

BOJ Governor Kazuo Ueda highlighted the presence of “extremely high” uncertainties in the economic outlook, emphasizing the need for caution. The central bank remains committed to sustaining accommodative monetary conditions until it observes sustainable and stable inflation. Exiting from the ultra-loose policy without concrete signs of meaningful wage growth could jeopardize the progress made thus far.

Impact on the Yen and Financial Markets

The BOJ’s decision to maintain its ultra-easy policy triggered a swift depreciation of the yen. Following the announcement, the yen weakened by over 1% against the U.S. dollar. Simultaneously, the Nikkei 225 stock index witnessed a 1.4% climb, reaching its highest closing level in nearly two weeks. These reactions indicate the market’s expectation that the BOJ’s accommodative measures will continue to support economic activity.

Wage Growth and Future Policy Adjustments

While the BOJ acknowledges the importance of wage growth in normalizing monetary policy, it remains cautious due to a slowing economy and cooling inflation. Governor Ueda hinted at potential changes in monetary policy next year, pending the outcome of the spring wage negotiations. If these negotiations confirm a trend of meaningful wage increases, it could pave the way for adjustments in the BOJ’s ultra-loose policy.

Inflation Outlook and Consumer Spending

The BOJ expects core inflation, which excludes food prices, to remain above 2% through fiscal 2024. However, the bank is mindful of the adverse impact of high inflation on consumer spending. Japan experienced its first quarterly economic contraction in over three years in the July to September quarter, partly attributed to reduced consumer spending resulting from high inflation. The BOJ aims for sustainable inflation driven by domestic demand, as it believes this will spur consumer spending and economic growth.

BOJ’s Unique Position and Global Implications

The BOJ’s ultra-easy monetary policy sets it apart from other major central banks, which have raised interest rates to combat stubbornly high inflation. This policy divergence has contributed to pressures on the yen and Japanese government bonds. Despite potential influences from the U.S. Federal Reserve’s decisions, Governor Ueda emphasized that the BOJ’s policy-making would not be directly swayed. The central bank remains focused on Japan’s economic conditions and will not rush into policy adjustments merely due to external factors.